|

||||||

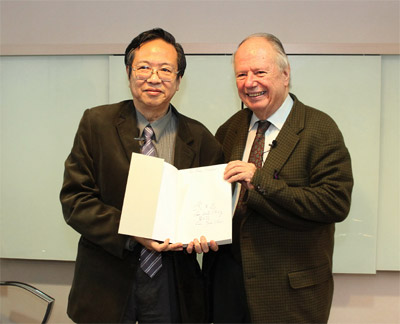

AWC President Rene Wadlow 's conversation with ITLRA Vice-Chairman Gee Keh-Chang about Taxation Human Rights of Non-Profit, Religious and Cultural Organizations

The two International Covenants recognize not only people’s freedom of thought, conscience and religion but also people’s rights to participate in cultural life. On Dec 8th, UN/NGO Association of World Citizens President Rene Wadlow met with Professors Gee Keh-Chang and Lan Yuan-Chun. As Taiwan’s tax code authority, Professor Gee is the Vice-Chairman of the International Tax Law Research Association and the Professor of College of Law, National Taiwan University. Professor Lan translated the ROC Centenary, Taxation and Human Rights White Paper from Chinese into English. Wadlow, Gee and Lan discussed in depth the tax human rights of non-profit, religious and cultural organizations in Taiwan. A ceremony was held for the presentation of both the Chinese and English versions of the White Paper, to Dr. Wadlow.

Professor Gee pointed out a common taxation issue with religious groups. People with religious beliefs may donate simply wishing to promote his faith; however, tax officials with either a different or without a religious belief often mistaken this contribution as profit-seeking income, thus wrongly apply tax to these donations. The concept of human rights needs to be enhanced to correct these mistaken beliefs. Even though the intention wasn’t to violate the freedoms of religions and beliefs, the result is nonetheless detrimental. This causes great damage to the development of religious activities.

“Nowadays the power of volunteering in Taiwan is extremely strong and NGOs’ development have become prosperous,” Professor Gee said, “But tax authorities seem to be outdated.” Tax authorities cannot tell the real NGOs from those established purposely to evade taxes. Therefore, the violation of human rights is unavoidable! Professor Gee pointed out that there are many articles written to prevent NGOs from evading taxes. For example, more than 70% of annual incomes shall be used. Under so many restricting tax codes, NGOs are unable to fully carry out their functions or long-term developments.

“So, we hope to enact Taxpayers’ Rights Protection Act in these years,” Professor Gee said, “The purpose of the act is for judges to keep the baseline so that the basic human rights can be protected by the judiciary system.” Professor Gee talked further about tax relief. Without professional tax courts and judges in our country, the judges usually incline to National Tax Administrations’ viewpoints. Professor Gee thought that it is not always necessary for a judge to be familiar with the details of tax codes. However, it is necessary for a judge to keep the baseline of basic human rights such as the freedom of occupation, religious faith and property. Protecting people’s basic human rights is actually judges’ most important mission. About the domestication of the two Covenants, Professor Gee said that he is trying hard to investigate the possibility of human rights violation caused by the government’s tax measures. With the internalization of human rights concepts, he hopes that the judges of administrative courts can decrease the number of violation cases. Dr. Wadlow raised the question about the training of administrative court judges. Professor Gee answered that more than one half of the administrative court cases are tax cases. Tax authorities are unaware of human rights, so Professor Gee hoped judges can compensate for this. However, domestic judges still lack in depth study of tax codes. Civil societies are working hard and hoping for the establishment of professional courts. There are, nevertheless, difficulties in the system. “We often organize conferences for the judges to participate in,” Professor Gee said, “But some judges just don’t care.” Professor Gee spoke of a specific approach for this year: they will choose 10 annual administrative court cases as candidates, and then vote for the annually best tax case. Among the indicators for voting, the most important factor will be the breakthrough for human rights awareness. Recognition of good tax cases will give support for righteous judges. Encourage him to continue the good work and set a good example for the other judges. Some of these cases are from the lower courts that were later rejected by the higher courts. These cases are good candidates too. We have even had a first trial case win the annual best tax case. Dr. Wadlow replied that there have also been some discussions about tax-exemption of religious organizations in America. Professor Gee said that he has organized a conference on the restriction of taxing religious societies in America, Japan, Germany and France. He also presented one of Taiwan’s case as an example. Dr. Wadlow admired Professor Gee’s efforts to improve the tax authorities and judges’ human rights awareness. Dr. Wadlow also highly praised the methodology of comparing international practices. Since Taiwan often interacts with the international community, the case taken has aroused international awareness. Dr. Wadlow further expressed that he will mail the English version of the Human Rights White Paper to a professor in Canada who has studied the comparison of taxation human rights. Dr. Wadlow hoped that what has been done can be known by the world because Taiwan has done a lot. The world may not know what has happened here. It is important to let Taiwan’s voice be heard.

|

||||||

|

|

|||||